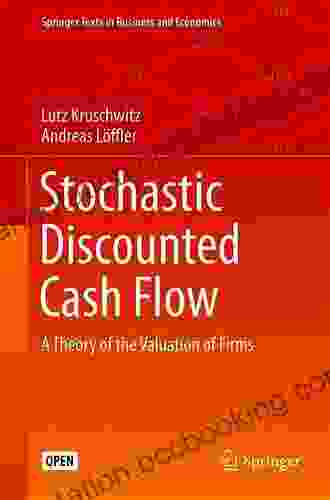

Stochastic Discounted Cash Flow: The Ultimate Guide to Investment Valuation

Stochastic Discounted Cash Flow (SDCF) is a powerful investment valuation technique that takes into account the uncertainty of future cash flows. This makes it a more realistic and accurate approach than traditional discounted cash flow (DCF) methods, which assume that future cash flows are known with certainty.

4.9 out of 5

| Language | : | English |

| File size | : | 43809 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 329 pages |

| Screen Reader | : | Supported |

SDCF is used to value a wide range of assets, including stocks, bonds, real estate, and private equity investments. It is also used to evaluate capital budgeting projects and make other investment decisions.

How Does SDCF Work?

SDCF is based on the principle of expected value. The expected value of a cash flow is the average amount of cash that is expected to be received or paid over the life of the asset. To calculate the expected value of a cash flow, we multiply each possible cash flow by its probability of occurrence.

Once we have calculated the expected value of each cash flow, we discount them back to the present day using a discount rate. The discount rate is the rate of return that we require to compensate us for the risk of investing in the asset.

The sum of the discounted expected cash flows is the SDCF value of the asset.

Advantages of SDCF

SDCF has several advantages over traditional DCF methods, including:

- It is more realistic. SDCF takes into account the uncertainty of future cash flows, which makes it a more realistic approach to investment valuation.

- It is more accurate. SDCF is more likely to produce accurate valuations than traditional DCF methods, which can be biased by overly optimistic assumptions about future cash flows.

- It is more flexible. SDCF can be used to value a wider range of assets than traditional DCF methods. This makes it a more versatile tool for investment analysis.

Applications of SDCF

SDCF is used in a wide range of investment applications, including:

- Stock valuation. SDCF is used to value stocks by forecasting future cash flows and discounting them back to the present day.

- Bond valuation. SDCF is used to value bonds by forecasting future coupon payments and principal payments and discounting them back to the present day.

- Real estate valuation. SDCF is used to value real estate by forecasting future rental income and expenses and discounting them back to the present day.

- Private equity valuation. SDCF is used to value private equity investments by forecasting future cash flows and discounting them back to the present day.

- Capital budgeting. SDCF is used to evaluate capital budgeting projects by forecasting future cash flows and discounting them back to the present day.

SDCF is a powerful investment valuation technique that takes into account the uncertainty of future cash flows. This makes it a more realistic and accurate approach than traditional DCF methods. SDCF is used in a wide range of investment applications, including stock valuation, bond valuation, real estate valuation, private equity valuation, and capital budgeting.

If you are interested in learning more about SDCF, I encourage you to read the book Stochastic Discounted Cash Flow: The Ultimate Guide to Investment Valuation. This book provides a comprehensive overview of SDCF, including its concepts, applications, and advantages.

I hope this article has been helpful. If you have any questions, please feel free to leave a comment below.

Thanks for reading!

4.9 out of 5

| Language | : | English |

| File size | : | 43809 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 329 pages |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia G A Matiasz

G A Matiasz Chelsea Clinton

Chelsea Clinton Pj Gardner

Pj Gardner Kenn Bivins

Kenn Bivins Lauren Bacall

Lauren Bacall John Cooper

John Cooper Herbie J Pilato

Herbie J Pilato D Harvey

D Harvey Maxine Wright Walters Ph D

Maxine Wright Walters Ph D Frost Kay

Frost Kay Amanda Grace Harrison

Amanda Grace Harrison Ted Loukes

Ted Loukes David Graeber

David Graeber Gareth Dale

Gareth Dale Gabrielle Euvino

Gabrielle Euvino Gabriel Baptista

Gabriel Baptista G I Gurdjieff

G I Gurdjieff G Tyler Mills

G Tyler Mills Luis Angel Echeverria

Luis Angel Echeverria S R Roberts

S R Roberts

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Deacon BellThe Man Who Declared War On America: The Untold Story of William Wallace, the...

Deacon BellThe Man Who Declared War On America: The Untold Story of William Wallace, the... Thomas HardyFollow ·13.2k

Thomas HardyFollow ·13.2k Chinua AchebeFollow ·11.7k

Chinua AchebeFollow ·11.7k Isaiah PriceFollow ·19k

Isaiah PriceFollow ·19k Douglas PowellFollow ·7.6k

Douglas PowellFollow ·7.6k Dave SimmonsFollow ·4.8k

Dave SimmonsFollow ·4.8k Hayden MitchellFollow ·14.2k

Hayden MitchellFollow ·14.2k Brett SimmonsFollow ·5.8k

Brett SimmonsFollow ·5.8k Ernest PowellFollow ·7.9k

Ernest PowellFollow ·7.9k

Voltaire

VoltaireStories From The Jim Crow Museum: Unveiling the Haunting...

A Journey into the Depths of...

F. Scott Fitzgerald

F. Scott FitzgeraldCalling Sorcery And Society: Illuminating the...

: The Alluring Embrace of Sorcery ...

Marcel Proust

Marcel ProustBranding Bud: Unveiling the Green Rush

As the legalization...

Henry Wadsworth Longfellow

Henry Wadsworth LongfellowColorful Dreamer: The Story of Artist Henri Matisse

Henri Matisse was a French artist...

Adrian Ward

Adrian WardDelving into the Tapestry of Black British Identity: A...

In the realm of historical...

4.9 out of 5

| Language | : | English |

| File size | : | 43809 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 329 pages |

| Screen Reader | : | Supported |